Offshore Wind & Subsea Power Cables | Market Trends by ORE Catapult

Published 01 Dec 2021

The following article, exploring offshore wind subsea power cables, has been republished with the kind permission from the authors: Othmane El Mountassir & Charlotte Strang-Moran from ORE Catapult | Published September 2018 | AP-0018

Installation, Operation & Trends

By the end of 2018, installed offshore wind power capacity will reach a total of 30.2GW, with 22.9GW of generation in Europe and 7.3GW across the rest of the world. The UK remains the global leader in offshore wind, with a total capacity of 6,385MW and an additional capacity of 3.2GW entering operation by 2020. As the industry’s generation capacity continues to grow, so does the need for developing reliable, high-capacity transmission cable technologies.

Subsea power cable failure is frequently reported as an issue for offshore wind farm operators. Such failures are reported to account for 75-80% of the total cost of offshore wind insurance claims – in comparison, cabling makes up only around 9% of the overall cost of an offshore wind farm. A lack of available data on cable failures led ORE Catapult to develop an interactive tool for internal use, which captures information about UK offshore wind projects and their power cables’ lifecycle from the installation to the operational phase.

This paper summarises some of the most pertinent insights on cable failures gleaned from the Catapult’s use of the tool and sets forth suggestions on how to improve knowledge-sharing in the offshore wind community to reduce the impact of future failures.

Headlines

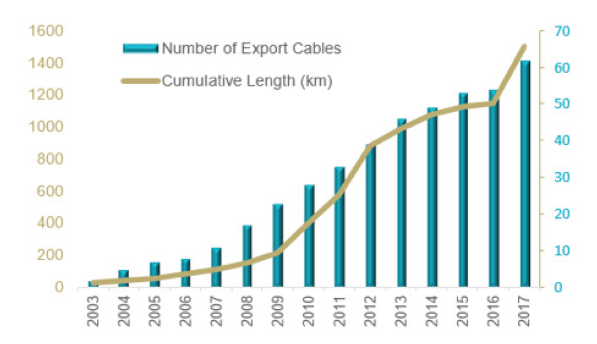

- The UK’s operational offshore wind farms are using 62 export cables totalling a length of 1,499km and over 1,806km of inter-array cables to transport the 6,385MW of electrical generation.

- A total of 43 array and export cable failures have been reported since 2007. Issues associated with manufacturing and/or installation are reported to be the most common cause of cable failure.

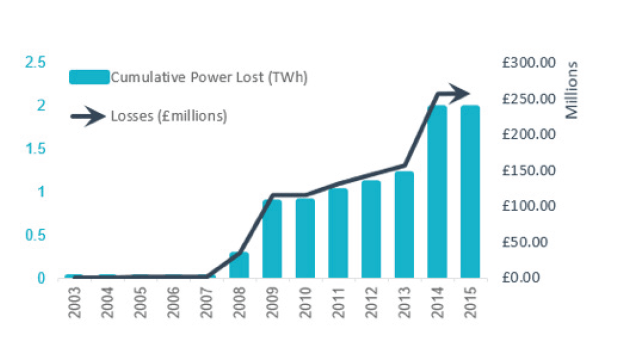

- From 2014 to the end of 2017, recorded cable failures at UK offshore wind projects have led to a cumulative loss of power generation of approximately 1.97TWh.

UK Offshore Wind Trends

The UK generates more electricity from offshore wind than any other country in the world. Operational offshore wind farms are currently generating 6,738MW using 1717 turbines.

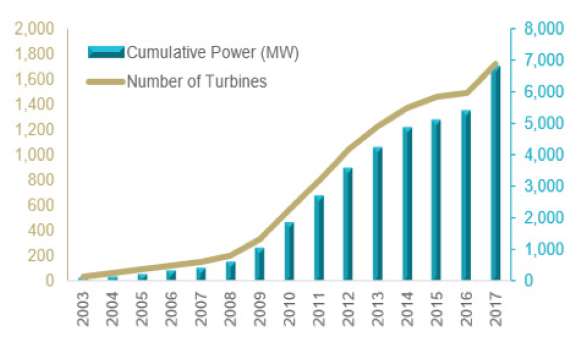

In 2017, the UK installed 1681MW, representing more than half of the new offshore wind power capacity built in Europe. It is forecasted that by 2020, there will be a record-breaking year for new capacity – largely driven by delayed wind farms and the deployment of large-capacity turbines in the 7MW 8MW range. The following figures provide an insight into current UK offshore wind sector trends.

Wind Development: By the end of 2018, installed offshore wind power capacity will reach a total of 30.2GW worldwide, with 22.9GW of generation in Europe and 7.3 GW in rest of the world. The UK remains the European country with the largest installed capacity, reaching a total capacity of 7,851 MW by the end of 2018.

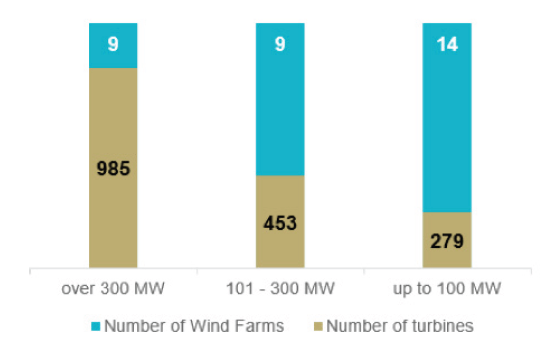

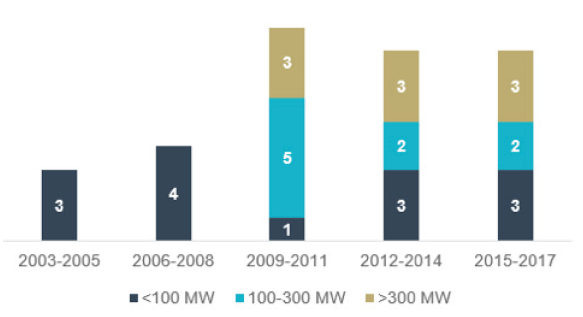

Farm Capacity: By categorising wind farms into three ranges of generation capacity, it can be seen that the larger the capacity range of the wind farms, the higher the number of wind turbines being used. It is expected that this trend will change with the deployment of higher-capacity turbines, reducing the number required.

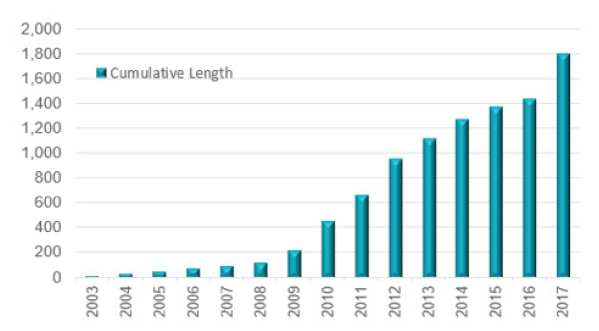

Progressive Trends: Since the development of the first demonstrator projects in 2003, the UK’s offshore wind sector has witnessed strong growth, supported by government incentives and investor confidence in the sector. This can be demonstrated in the figure above, where we can see over the years an increase in the number of offshore wind farms and demonstrators with different generation capacities.

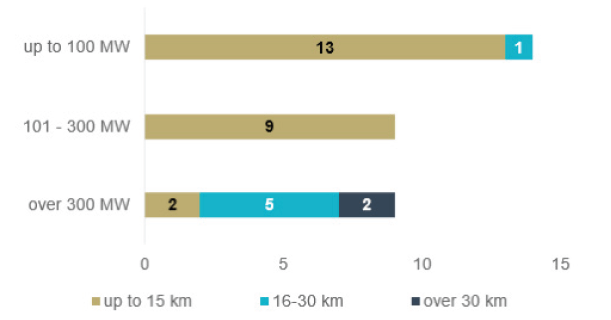

Distance from Shore: The UK’s geographic location makes it ideal for offshore wind generation. Early developments from the Round 1 and Round 2 leasing phases were relatively small and close to shore. In contrast, recent projects and future developments have seen and will see this distance increase to the 50-90km range from shore to take advantage of the wind strength in these areas.

Subsea Cable Trends

The rapid growth of the offshore wind sector has led to the development of a number of new subsea cable technologies. This was mainly supported by a robust cable-related supply chain with leading organisations in manufacturing, services and academia present across the UK. The demand for subsea power cables will continue to grow at a fast pace to support both future offshore wind development and the subsea power interconnector sector.

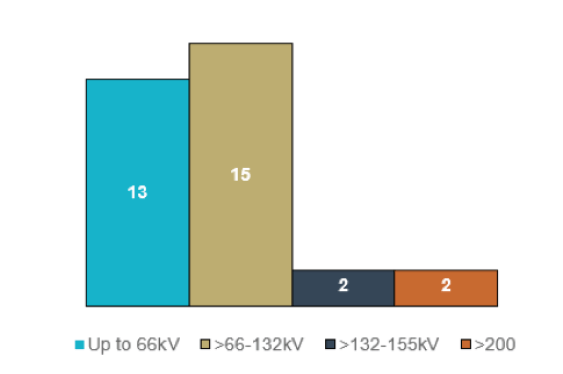

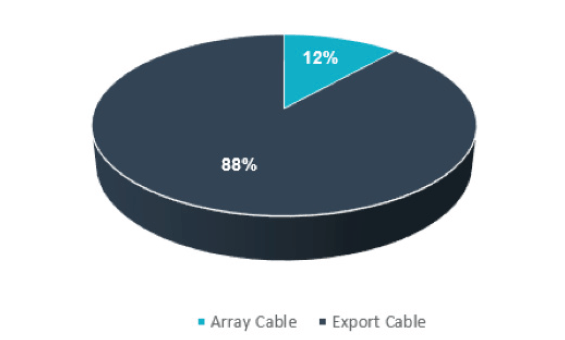

Export Cables are vital for transmission of the generated power to the grid. The UK’s operational offshore wind farms are using 62 export cables totalling a length of 1,499km. The voltage levels of these cables range from 33kV for nearshore wind farms without offshore substations, and up to 132kV, 150kV and 220kV for further-offshore sites with one or two substations.

Export Cable Trends: Research and development activity has led to the development of new cable technologies. Since 2013, over 80% of projects in Europe have deployed export cables with a voltage greater than 150kV. Reflecting the rapid development of cable technologies, 80% of projects commissioned in 2018 will be using cables with a voltage level greater than 200kV.

Array Cable Development: There are over 1,806km of inter-array cables in UK waters. To maximise generation revenue and achieve Levelised Cost of Energy reductions, offshore wind projects will continue to increase in size.

As such, the lengths of array cabling used is expected to increase due to the increased number of turbines and the distance between them.

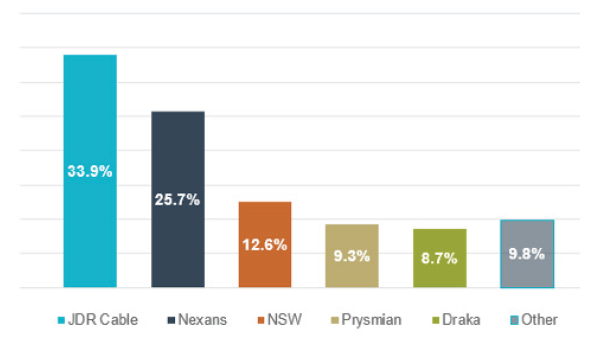

Array Cable Manufacturers: The cable market is generally global in nature and there are a number of suppliers available. A notable UK success has been achieved with JDR cables, which has supplied numerous UK offshore wind projects, as well as several overseas projects. The expansion of the market and growth of an indigenous UK supply chain is expected to help reduce costs.

Cable Failure Trends

According to industry data obtained by the Catapult, cables account for the largest number of insurance claims in the offshore wind sector. Though subsea cable failures are reported often, publicly-available information remains scarce. The following figures, gleaned from the Catapult’s internal cable database, provide an insight into reported subsea power cable failures in the UK’s offshore wind sector.

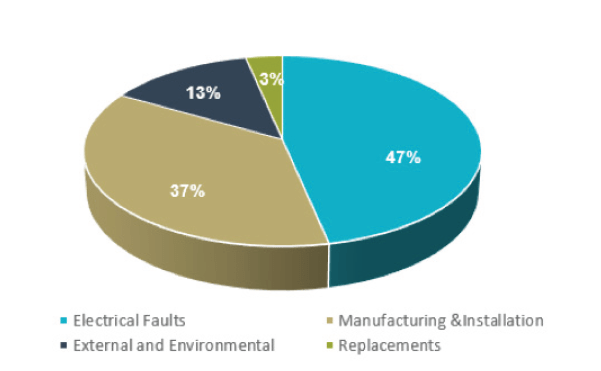

Cable Failure: Incidents relating to the installation and operation of subsea power cables are found to be the most costly cause of financial losses in offshore wind industry. Since 2007, 43 known failures of wind farm array and export cables were reported. The issues associated with these failures vary in nature.

Causes of Failure: Issues associated with the manufacturing and/or installation phase are reported to be the most common cause of cable failure. The failure events reported include cases where unplanned faults have occurred, or when planned, pre-emptive repairs have been required to avoid the likelihood of fault.

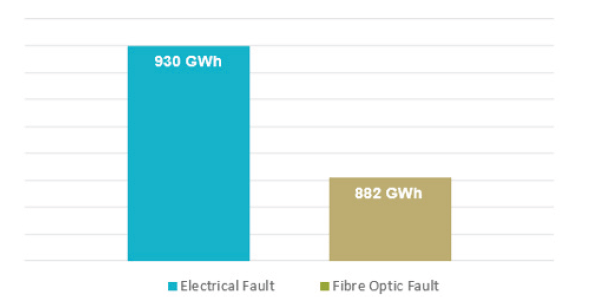

Fibre Optic and Electrical Faults: In the UK’s offshore wind sector, recorded faults of electrical origin were found to be higher than fibre optics failures. To date, power losses due to fibre optics failure reached an estimated value of 600GWh, while losses due to electrical faults were estimated at 1,160GWh. It should be noted that electrical failures may sometimes lead to the failure of fibre optics.

Costs of Failure: The cost of a cable failure can be considerable, taking into account repair costs and generation revenue loss. From 2014 until the end of 2017, recorded cable failures at UK projects have led to a cumulative generation loss of approx. 1.97TWh, equating to approx. £227M*. This figure demonstrates beyond doubt that the sector is still in need of innovative cable installation and repair technologies. *Based on a strike price of £115/MWh.

Discussion and Next Steps

The UK has a robust subsea cable-related supply chain, encompassing manufacturing, service providers and academia. However, there is still a lack of communication between stakeholder groups. For example, the standardisation of cable installation practices may lead to fewer installation issues, while the dissemination of learned experiences can be used to predict or avoid certain failures and also bridge innovation gaps in manufacturing. However, this is only possible if the parties involved are willing to share the required records. There is a consensus from market stakeholders that subsea cable project activities are currently dispersed, and a more structured and co-ordinated process is required to pull promising technology and ideas through development and demonstration. However, proposed concepts aimed at developing a subsea cable database, which informs and enables stakeholders to identify and bridge gaps in innovation – has been met with scepticism from a number of systems owners and operators; questions remain over whether a live, regularly-updated database would be providing ongoing value and longevity.

To ensure the successful development and implementation of appropriate technologies and processes aimed at reducing cable failures within the offshore wind industry, ORE Catapult is acting as a driver for a number of initiatives such as the Offshore Wind Innovation Hub, subsea cable innovation challenges, and technology demonstration opportunities for SMEs at its Levenmouth Demonstration Turbine. The Catapult also anticipates launching a publicly-available web-based platform dedicated to subsea power cables. To help solve some of the challenges around offshore wind subsea cable applications, ORE Catapult has developed a dedicated internal database and an Offshore Wind Innovation Hub strategic programme dedicated to subsea power cables and future systems. The aim of the internal cable database platform is to provide quantitative information and evidence to support building a consensus to solve common cable issues, while the Offshore Wind Innovation Hub was established to co-ordinate the sector’s innovation needs and provide a comprehensive view of the research funding opportunities available.

It is beyond question that the offshore wind sector will continue to expand further over the coming decades. Future wind farms will make use of higher-capacity turbines and will be located further offshore: with that comes the requirement for robust cable technologies and safe installation and operational practices. The sector must learn from the wider industry and share information and lessons learned so that costs can continue to fall, helping the wider offshore wind supply chain continue its trajectory of growth.

Further Reading

Lead-Free Cables | The Future for Offshore Wind Farms

Providing Electrical Safety & PPE to Offshore Wind Farm Workers

Pipe & Cable Seals for Offshore Windfarm Substations, Enclosures & Foundation

LV, MV & HV JOINTING, EARTHING, SUBSTATION & ELECTRICAL EQPT

Thorne & Derrick are Specialist Distributors to the UK and international Offshore Wind & Renewable industry to provide safe and reliable LV HV Electrical Cable & Power Distribution Systems up to 66kV – we are highly customer responsive and absolutely committed to providing a world-class service.

Contact our UK Power Team for competitive quotations, fast delivery from stock and technical support or training on all LV-HV products.

Key Product Categories: Duct Seals | Cable Cleats | Cable Glands | Electrical Safety | Arc Flash Protection | Cable Jointing Tools | Cable Pulling | Earthing | Feeder Pillars | Cable Joints LV | Joints & Terminations MV HV

See how T&D support, supply and service the Renewable Energy industry.

MV HV Cables 11kV 33kV 66kV | Cable Joints, Terminations & Connections