Events & Webinars

July 28th, 2021

Get your ticket here

Safely Sustaining Switchgear

Presented By HV Expert Group

A celebration of circuits at The National Motorcycle Museum! Created for Maintenance Engineers who operate or need knowledge of high voltage electrical equipment and assets.

Date and Time

Wed, 15 September 2021

08:30 – 15:00 BST

Location

The National Motorcycle Museum

Hampton in Arden

Solihull

Birmingham

B92 0EJ

Get your ticket here – https://www.eventbrite.co.uk/e/safely-sustaining-switchgear-tickets-154673042233?ref=eios

About this Event

Free of charge for those who are part of the maintenance teams. Others welcome but we ask for a contribution towards costs.

A focus on switchgear with an agenda that brings other key assets into focus. Lots of breakouts to network and meet new engineering contacts.

- Relevant

- Interesting

- Enjoyable

| Time |

Activity |

Remarks |

| 0830-0915 |

Arrival, Registration

View exhibitors and network |

Exhibition opens |

| 0915-0930 |

Welcome and overview to the day |

Jason Butler

Pumptec Engineering |

| 0930-1015 |

LV electrical compliance for duty holders

Don’t underestimate its safety management |

Michael Kenyon

Bureau Veritas |

| 1015-1100 |

Internal Arc Flash classification of High Voltage Switchgear |

Paul Dale

Powell Industries |

1100-1130

Coffee, networking and view exhibitors |

| 1130-1200 |

Switchgear mechanisms |

Phil Hooper

Interflon |

| 1200-1230 |

Digitally transforming Safety Management

Save lives, save cost, motivate colleagues |

Paul Richardson

2innov8 Ltd |

1230-1315

Lunch and view exhibitors |

| 1315-1345 |

High Voltage AC-DC

Lessons from an electrifying musician |

Peter Cook

Rock Academy |

| 1345-1400 |

Partial Discharge Case Study – find it early |

Stephen Holmes

Irenka Services |

| 1400-1430 |

Energy Saving Case Study on Air Handling Units |

Jason Butler

Pumptc Engineering |

| 1430-1500 |

Circuit breaker testing and technology |

Dave Gibb

DV Power |

| 1500-1515 |

HV Expert Group next event Discussion

Key topics and requests from attendees

Summary of the day |

Jason Butler |

1515-1630

Coffee, Networking and view exhibitors

Museum available |

1630

Event closes |

Arc Flash Learning & Resources

Thorne and Derrick are proud to be distributors of ProGARM arc flash rated clothing and protection.

We can help – should you require arc flash calculators or advice on the type of clothing and protection available please do not hesitate to contact us.

June 15th, 2021

Medium Voltage Cable Accessories

Foreword

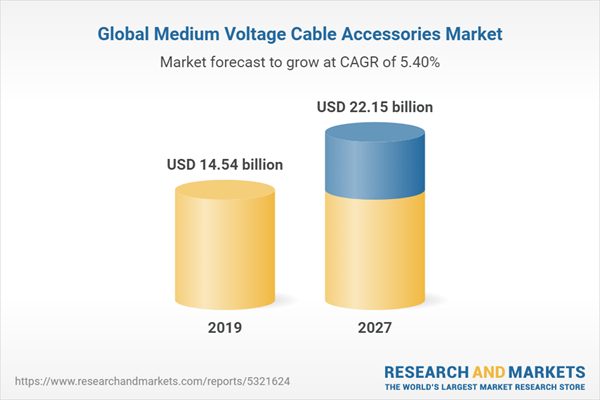

The “Medium Voltage Cable Accessories Market by Product Type, Technology, Installation and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2019-2027” report has been added to ResearchAndMarkets.com’s offering.

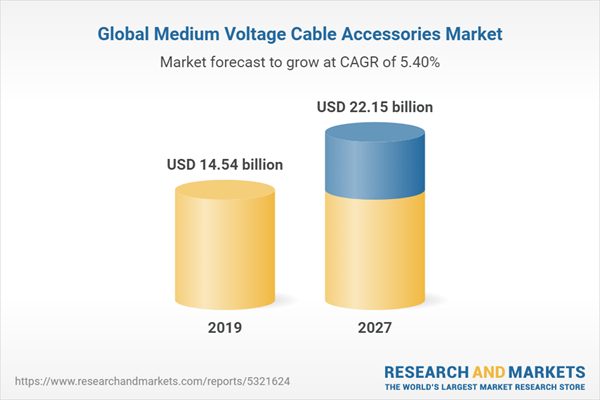

The Global medium voltage cable accessories market was valued at $16.82 billion in 2019, and is projected to reach $22.15 billion by 2027, registering a CAGR of 5.40% from 2020 to 2027. Medium voltage (MV) is a range of electricity distribution system voltages from 3.3kV to 33kV. Cable accessories for medium voltage have similar design and performance requirements as that of cables of same voltage range.

A substantial investment in the construction sector majorly drives the growth of the global medium voltage cable accessories market, as growth of the construction sector directly increases the demand for medium voltage cable accessories for new constructions.

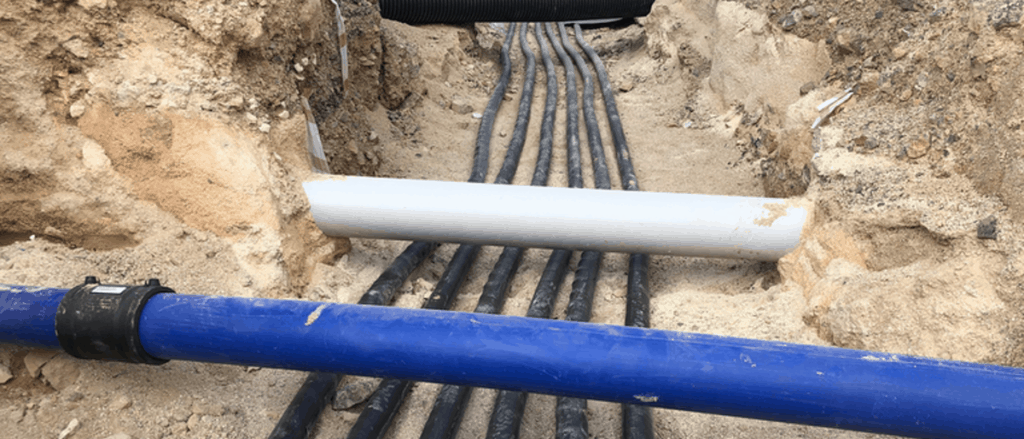

Moreover, surge in use of underground cables with rise in urbanization and industrialization, increase investments for infrastructure development both by private and public sector, and rise in focus on sustainable ways of generating electricity are expected to boost market growth.

Furthermore, growth in adoption of e-mobility, surge in governmental initiatives to provide electricity for all, and surge in number of data centers are expected to provide lucrative growth opportunities for the market. However, high rate of failure of heat shrink medium voltage cable accessories are expected to hinder the growth of the global medium voltage cable accessories market.

The global medium voltage cable accessories market is analyzed by product type, technology, industry vertical, and region. By product type, it is fragmented into cable joints & splice, connectors, terminations, and other product types. By technology, the market is segregated into heat shrink, cold shrink, and pre-molded terminations.

By installation, the market is analyzed across overhead, underground, and submarine. By industry vertical, the market is divided into railways, construction, private utilities, cement, marine, government utilities, oil & gas, healthcare, fertilizer, steel, and others.

Based on region, the global medium voltage cable accessories market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, and rest of Europe), Asia-Pacific (China, India, Japan, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

The key players operating in the market include 3M, Compaq International (P) Limited, Nexans, NKT A/S, Phoenix Technology Group Co., Ltd., Raychem AG, REPL International Limited, Sumitomo Electric U.S.A., Inc., TE Connectivity, and Yamuna Infra & Technology Pvt.

KEY MARKET SEGMENTS

By PRODUCT TYPE

- Cable Joints & Splice

- Connectors

- Terminations

- Other Product Types

By TECHNOLOGY

- Heat Shrink

- Cold Shrink

- Pre-molded Terminations

By INSTALLATION

- Overhead

- Underground

- Submarine

By INDUSTRY VERTICAL

- Railways

- Construction

- Private Utilities

- Cement

- Marine

- Government Utilities

- Oil & Gas

- Healthcare

- Fertilizer

- Steel

- Others

By REGION

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

KEY PLAYERS

- 3M

- Compaq International (P) Limited

- Nexans

- NKT A/S

- Phoenix Technology Group Co., Ltd

- Raychem AG

- REPL International Limited

- Sumitomo Electric U.S.A., Inc.

- TE Connectivity

- Yamuna Infra & Technology Pvt. Ltd.

Table of Contents

Chapter 1: Introduction

1.1. Report Description

1.2. Key Benefits for Stakeholders

1.3. Key Market Segments

1.4. Research Methodology

1.4.1. Primary Research

1.4.2. Secondary Research

1.4.3. Analyst Tools and Models

Chapter 2: Executive Summary

2.1. Key Findings

2.1.1. Top Impacting Factors

2.1.2. Top Investment Pockets

2.2. Cxo Perspective

Chapter 3: Market Overview

3.1. Market Definition and Scope

3.2. Porter’s Five Forces Analysis

3.3. Market Dynamics

3.3.1. Drivers

3.3.1.1. Increase Investments by Governments to Improve Power Grid

3.3.1.2. Increase in Use of Underground Cables

3.3.1.3. Growth Investments in Construction Sector

3.3.2. Restraint

3.3.2.1. High Failure Rate of Medium Voltage Cable Accessories

3.3.3. Opportunities

3.3.3.1. Rise in Use of E-Mobility

3.3.3.2. Surge in Number of Data Centers

3.4. COVID Impact

3.4.1. Impact on Market Size

3.4.2. Impact on Product Pricing

3.4.3. Industry Vertical Trends, Preferences, and Budget Impact

3.4.4. Key Player Strategies to Tackle Negative Impact

3.4.4.1. Limiting Cuts to R&D Expense

3.4.4.2. Focusing on Next-Generation Products

3.4.4.3. Shifting Toward Agile Supply Chain Model

3.4.5. Opportunity Window

Chapter 4: Medium Voltage Cable Accessories Market, by Product Type

4.1. Overview

4.2. Cable Joints & Splice

4.2.1. Key Market Trends, Growth Factors, and Opportunities

4.2.2. Market Size and Forecast, by Region

4.2.3. Market Analysis, by Country

4.3. Connectors

4.3.1. Key Market Trends, Growth Factors, and Opportunities

4.3.2. Market Size and Forecast, by Region

4.3.3. Market Analysis, by Country

4.4. Terminations

4.4.1. Key Market Trends, Growth Factors, and Opportunities

4.4.2. Market Size and Forecast, by Region

4.4.3. Market Analysis, by Country

4.5. Others

4.5.1. Key Market Trends, Growth Factors, and Opportunities

4.5.2. Market Size and Forecast, by Region

4.5.3. Market Analysis, by Country

Chapter 5: Medium Voltage Cable Accessories Market, by Technology

5.1. Overview

5.2. Heat Shrink

5.2.1. Key Market Trends, Growth Factors, and Opportunities

5.2.2. Market Size and Forecast, by Region

5.2.3. Market Analysis, by Country

5.3. Cold Shrink

5.3.1. Key Market Trends, Growth Factors, and Opportunities

5.3.2. Market Size and Forecast, by Region

5.3.3. Market Analysis, by Country

5.4. Pre-Molded Terminations

5.4.1. Key Market Trends, Growth Factors, and Opportunities

5.4.2. Market Size and Forecast, by Region

5.4.3. Market Analysis, by Country

Chapter 6: Medium Voltage Cable Accessories Market, by Installation

6.1. Overview

6.2. Overhead

6.2.1. Key Market Trends, Growth Factors, and Opportunities

6.2.2. Market Size and Forecast, by Region

6.2.3. Market Analysis, by Country

6.3. Underground

6.3.1. Key Market Trends, Growth Factors, and Opportunities

6.3.2. Market Size and Forecast, by Region

6.3.3. Market Analysis, by Country

6.4. Submarine

6.4.1. Key Market Trends, Growth Factors, and Opportunities

6.4.2. Market Size and Forecast, by Region

6.4.3. Market Analysis, by Country

Chapter 7: Medium Voltage Cable Accessories Market, by Industry Vertical

7.1. Overview

7.2. Railways

7.2.1. Key Market Trends, Growth Factors, and Opportunities

7.2.2. Market Size and Forecast, by Region

7.2.3. Market Analysis, by Country

7.3. Construction

7.3.1. Key Market Trends, Growth Factors, and Opportunities

7.3.2. Market Size and Forecast, by Region

7.3.3. Market Analysis, by Country

7.4. Private Utilities

7.4.1. Key Market Trends, Growth Factors, and Opportunities

7.4.2. Market Size and Forecast, by Region

7.4.3. Market Analysis, by Country

7.5. Cement

7.5.1. Key Market Trends, Growth Factors, and Opportunities

7.5.2. Market Size and Forecast, by Region

7.5.3. Market Analysis, by Country

7.6. Marine

7.6.1. Key Market Trends, Growth Factors, and Opportunities

7.6.2. Market Size and Forecast, by Region

7.6.3. Market Analysis, by Country

7.7. Government Utilities

7.7.1. Key Market Trends, Growth Factors, and Opportunities

7.7.2. Market Size and Forecast, by Region

7.7.3. Market Analysis, by Country

7.8. Oil & Gas

7.8.1. Key Market Trends, Growth Factors, and Opportunities

7.8.2. Market Size and Forecast, by Region

7.8.3. Market Analysis, by Country

7.9. Healthcare

7.9.1. Key Market Trends, Growth Factors, and Opportunities

7.9.2. Market Size and Forecast, by Region

7.9.3. Market Analysis, by Country

7.10. Fertilizer

7.10.1. Key Market Trends, Growth Factors, and Opportunities

7.10.2. Market Size and Forecast, by Region

7.10.3. Market Analysis, by Country

7.11. Steel

7.11.1. Key Market Trends, Growth Factors, and Opportunities

7.11.2. Market Size and Forecast, by Region

7.11.3. Market Analysis, by Country

7.12. Others

7.12.1. Key Market Trends, Growth Factors, and Opportunities

7.12.2. Market Size and Forecast, by Region

7.12.3. Market Analysis, by Country

Chapter 8: Medium Voltage Cable Accessories Market, by Region

8.1. Overview

8.2. North America

8.2.1. Key Market Trends, Growth Factors, and Opportunities

8.2.2. Market Size and Forecast, by Product Type

8.2.3. Market Size and Forecast, by Technology

8.2.4. Market Size and Forecast, by Installation

8.2.5. Market Size and Forecast, by Industry Vertical

8.2.6. Market Analysis, by Country

8.2.6.1. U.S.

8.2.6.1.1. Market Size and Forecast, by Product Type

8.2.6.1.2. Market Size and Forecast, by Technology

8.2.6.1.3. Market Size and Forecast, by Installation

8.2.6.1.4. Market Size and Forecast, by Industry Vertical

8.2.6.2. Canada

8.2.6.2.1. Market Size and Forecast, by Product Type

8.2.6.2.2. Market Size and Forecast, by Technology

8.2.6.2.3. Market Size and Forecast, by Installation

8.2.6.2.4. Market Size and Forecast, by Industry Vertical

8.2.6.3. Mexico

8.2.6.3.1. Market Size and Forecast, by Product Type

8.2.6.3.2. Market Size and Forecast, by Technology

8.2.6.3.3. Market Size and Forecast, by Installation

8.2.6.3.4. Market Size and Forecast, by Industry Vertical

8.3. Europe

8.3.1. Key Market Trends, Growth Factors, and Opportunities

8.3.2. Market Size and Forecast, by Product Type

8.3.3. Market Size and Forecast, by Technology

8.3.4. Market Size and Forecast, by Installation

8.3.5. Market Size and Forecast, by Industry Vertical

8.3.6. Market Analysis, by Country

8.3.6.1. UK

8.3.6.1.1. Market Size and Forecast, by Product Type

8.3.6.1.2. Market Size and Forecast, by Technology

8.3.6.1.3. Market Size and Forecast, by Installation

8.3.6.1.4. Market Size and Forecast, by Industry Vertical

8.3.6.2. Germany

8.3.6.2.1. Market Size and Forecast, by Product Type

8.3.6.2.2. Market Size and Forecast, by Technology

8.3.6.2.3. Market Size and Forecast, by Installation

8.3.6.2.4. Market Size and Forecast, by Industry Vertical

8.3.6.3. France

8.3.6.3.1. Market Size and Forecast, by Product Type

8.3.6.3.2. Market Size and Forecast, by Technology

8.3.6.3.3. Market Size and Forecast, by Installation

8.3.6.3.4. Market Size and Forecast, by Industry Vertical

8.3.6.4. Rest of Europe

8.3.6.4.1. Market Size and Forecast, by Product Type

8.3.6.4.2. Market Size and Forecast, by Technology

8.3.6.4.3. Market Size and Forecast, by Installation

8.3.6.4.4. Market Size and Forecast, by Industry Vertical

8.4. Asia-Pacific

8.4.1. Key Market Trends, Growth Factors, and Opportunities

8.4.2. Market Size and Forecast, by Product Type

8.4.3. Market Size and Forecast, by Technology

8.4.4. Market Size and Forecast, by Installation

8.4.5. Market Size and Forecast, by Industry Vertical

8.4.6. Market Analysis, by Country

8.4.6.1. China

8.4.6.1.1. Market Size and Forecast, by Product Type

8.4.6.1.2. Market Size and Forecast, by Technology

8.4.6.1.3. Market Size and Forecast, by Installation

8.4.6.1.4. Market Size and Forecast, by Industry Vertical

8.4.6.2. Japan

8.4.6.2.1. Market Size and Forecast, by Product Type

8.4.6.2.2. Market Size and Forecast, by Technology

8.4.6.2.3. Market Size and Forecast, by Installation

8.4.6.2.4. Market Size and Forecast, by Industry Vertical

8.4.6.3. India

8.4.6.3.1. Market Size and Forecast, by Product Type

8.4.6.3.2. Market Size and Forecast, by Technology

8.4.6.3.3. Market Size and Forecast, by Installation

8.4.6.3.4. Market Size and Forecast, by Industry Vertical

8.4.6.4. Rest of Asia-Pacific

8.4.6.4.1. Market Size and Forecast, by Product Type

8.4.6.4.2. Market Size and Forecast, by Technology

8.4.6.4.3. Market Size and Forecast, by Installation

8.4.6.4.4. Market Size and Forecast, by Industry Vertical

8.5. LAMEA

8.5.1. Key Market Trends, Growth Factors, and Opportunities

8.5.2. Market Size and Forecast, by Product Type

8.5.3. Market Size and Forecast, by Technology

8.5.4. Market Size and Forecast, by Installation

8.5.5. Market Size and Forecast, by Industry Vertical

8.5.6. Market Analysis, by Country

8.5.6.1. Latin America

8.5.6.1.1. Market Size and Forecast, by Product Type

8.5.6.1.2. Market Size and Forecast, by Technology

8.5.6.1.3. Market Size and Forecast, by Installation

8.5.6.1.4. Market Size and Forecast, by Industry Vertical

8.5.6.2. Middle East

8.5.6.2.1. Market Size and Forecast, by Product Type

8.5.6.2.2. Market Size and Forecast, by Technology

8.5.6.2.3. Market Size and Forecast, by Installation

8.5.6.2.4. Market Size and Forecast, by Industry Vertical

8.5.6.3. Africa

8.5.6.3.1. Market Size and Forecast, by Product Type

8.5.6.3.2. Market Size and Forecast, by Technology

8.5.6.3.3. Market Size and Forecast, by Installation

8.5.6.3.4. Market Size and Forecast, by Industry Vertical

Chapter 9: Competitive Landscape

9.1. Introduction

9.1.1. Market Player Positioning, 2019

9.2. Product Mapping of Top 10 Player

9.3. Competitive Dashboard

9.4. Competitive Heatmap

Chapter 10: Company Profiles

10.1.3M

10.1.1. Company Overview

10.1.2. Key Executives

10.1.3. Company Snapshot

10.1.4. Operating Business Segments

10.1.5. Product Portfolio

10.1.1. R&D Expenditure

10.1.2. Business Performance

10.2. Behr Bircher Cellpack Bbc Ag

10.2.1. Company Overview

10.2.2. Key Executives

10.2.3. Company Snapshot

10.2.4. Operating Business Segments

10.2.5. Product Portfolio

10.3. Compaq International (P) Ltd.

10.3.1. Company Overview

10.3.2. Key Executives

10.3.3. Company Snapshot

10.3.4. Operating Business Segments

10.3.5. Product Portfolio

10.4. Nexans

10.4.1. Company Overview

10.4.2. Key Executives

10.4.3. Company Snapshot

10.4.4. Operating Business Segments

10.4.5. Product Portfolio

10.4.6. Business Performance

10.4.7. Key Strategic Moves and Developments

10.5. Nkt A/S

10.5.1. Company Overview

10.5.2. Key Executives

10.5.3. Company Snapshot

10.5.4. Operating Business Segments

10.5.5. Product Portfolio

10.5.6. R&D Expenditure

10.5.7. Business Performance

10.5.8. Key Strategic Moves and Developments

10.6. Phoenix Technology Group Co. Ltd

10.6.1. Company Overview

10.6.2. Key Executives

10.6.3. Company Snapshot

10.6.4. Operating Business Segments

10.6.5. Product Portfolio

10.7. Repl International

10.7.1. Company Overview

10.7.2. Key Executives

10.7.3. Company Snapshot

10.7.4. Operating Business Segments

10.7.5. Product Portfolio

10.7.6. Business Performance

10.8. Sumitomo Electric U.S. A., Inc.

10.8.1. Company Overview

10.8.2. Key Executives

10.8.3. Company Snapshot

10.8.4. Operating Business Segments

10.8.5. Product Portfolio

10.8.6. R&D Expenditure

10.8.7. Business Performance

10.9. Te Connectivity

10.9.1. Company Overview

10.9.2. Key Executives

10.9.3. Company Snapshot

10.9.4. Operating Business Segments

10.9.5. Product Portfolio

10.9.6. R&D Expenditure

10.9.7. Business Performance

10.10. Yamuna Infra & Technology Pvt. Ltd.

10.10.1. Company Overview

10.10.2. Key Executives

10.10.3. Company Snapshot

10.10.4. Operating Business Segments

10.10.5. Product Portfolio

List of Tables

Table 01. Medium Voltage Cable Accessories Market for Cable Joints & Splice, by Region, 2019-2027 ($Million)

Table 02. Medium Voltage Cable Accessories Market for Connectors, by Region 2019-2027 ($Million)

Table 03. Medium Voltage Cable Accessories Market for Terminations, by Region 2019-2027 ($Million)

Table 04. Medium Voltage Cable Accessories Market for Others, by Region 2019-2027 ($Million)

Table 05. Global Medium Voltage Cable Accessories Market, by Technology, 2019-2027($Million)

Table 06. Medium Voltage Cable Accessories Market for Heat Shrink, by Region 2019-2027 ($Million)

Table 07. Medium Voltage Cable Accessories Market for Cold Shrink, by Region 2019-2027 ($Million)

Table 08. Medium Voltage Cable Accessories Market for Pre-Molded Terminations, by Region 2019-2027 ($Million)

Table 09. Global Medium Voltage Cable Accessories Market, by Installation, 2019-2027($Million)

Table 10. Overhead Medium Voltage Cable Accessories Market, by Region 2019-2027 ($Million)

Table 11. Underground Medium Voltage Cable Accessories Market , by Region 2019-2027 ($Million)

Table 12. Submedium Voltage Cable Accessories Market for Marine , by Region 2019-2027 ($Million)

Table 13. Global Medium Voltage Cable Accessories Market, by Industry Vertical, 2019-2027($Million)

Table 14. Medium Voltage Cable Accessories Market for Railways, by Region 2019-2027 ($Million)

Table 15. Medium Voltage Cable Accessories Market for Construction, by Region 2019-2027 ($Million)

Table 16. Medium Voltage Cable Accessories Market for Private Utilities, by Region 2019-2027 ($Million)

Table 17. Medium Voltage Cable Accessories Market for Cement, by Region 2019-2027 ($Million)

Table 18. Medium Voltage Cable Accessories Market for Marine, by Region 2019-2027 ($Million)

Table 19. Medium Voltage Cable Accessories Market for Government Utilities, by Region 2019-2027 ($Million)

Table 20. Medium Voltage Cable Accessories Market for Oil & Gas, by Region 2019-2027 ($Million)

Table 21. Medium Voltage Cable Accessories Market for Healthcare, by Region 2019-2027 ($Million)

Table 22. Medium Voltage Cable Accessories Market for Fertilizer, by Region 2019-2027 ($Million)

Table 23. Medium Voltage Cable Accessories Market for Steel, by Region 2019-2027 ($Million)

Table 24. Medium Voltage Cable Accessories Market for Others, by Region 2019-2027 ($Million)

Table 25. Medium Voltage Cable Accessories Market Revenue, by Region, 2019-2027 ($Million)

Table 26. North America Medium Voltage Cable Accessories Market, by Product Type, 2019-2027 ($Million)

Table 27. North America Medium Voltage Cable Accessories Market, by Technology, 2019-2027 ($Million)

Table 28. North America Medium Voltage Cable Accessories Market, by Installation, 2019-2027 ($Million)

Table 29. North America Medium Voltage Cable Accessories Market, by Industry Vertical, 2019-2027 ($Million)

Table 30. U.S. Medium Voltage Cable Accessories Market, by Product Type, 2019-2027 ($Million)

Table 31. U.S. Medium Voltage Cable Accessories Market, by Technology, 2019-2027 ($Million)

Table 32. U.S. Medium Voltage Cable Accessories Market, by Installation, 2019-2027 ($Million)

Table 33. U.S. Medium Voltage Cable Accessories Market, by Industry Vertical, 2019-2027 ($Million)

Table 34. Canada Medium Voltage Cable Accessories Market, by Product Type, 2019-2027 ($Million)

Table 35. Canada Medium Voltage Cable Accessories Market, by Technology, 2019-2027 ($Million)

Table 36. U.S. Medium Voltage Cable Accessories Market, by Installation, 2019-2027 ($Million)

Table 37. Canada Medium Voltage Cable Accessories Market, by Industry Vertical, 2019-2027 ($Million)

Table 38. Mexico Medium Voltage Cable Accessories Market, by Product Type, 2019-2027 ($Million)

Table 39. Mexico Medium Voltage Cable Accessories Market, by Technology, 2019-2027 ($Million)

Table 40. U.S. Medium Voltage Cable Accessories Market, by Installation, 2019-2027 ($Million)

Table 41. Mexico Medium Voltage Cable Accessories Market, by Industry Vertical, 2019-2027 ($Million)

Table 42. Europe Medium Voltage Cable Accessories Market, by Product Type, 2019-2027 ($Million)

Table 43. Europe Medium Voltage Cable Accessories Market, by Technology, 2019-2027 ($Million)

Table 44. Europe Medium Voltage Cable Accessories Market, by Installation, 2019-2027 ($Million)

Table 45. Europe Medium Voltage Cable Accessories Market, by Industry Vertical, 2019-2027 ($Million)

Table 46. UK Medium Voltage Cable Accessories Market, by Product Type, 2019-2027 ($Million)

Table 47. UK Medium Voltage Cable Accessories Market, by Technology, 2019-2027 ($Million)

Table 48. UK Medium Voltage Cable Accessories Market, by Installation, 2019-2027 ($Million)

Table 49. UK Medium Voltage Cable Accessories Market, by Industry Vertical, 2019-2027 ($Million)

Table 50. Germany Medium Voltage Cable Accessories Market, by Product Type, 2019-2027 ($Million)

Table 51. Germany Medium Voltage Cable Accessories Market, by Technology, 2019-2027 ($Million)

Table 52. Germany Medium Voltage Cable Accessories Market, by Installation, 2019-2027 ($Million)

Table 53. Germany Medium Voltage Cable Accessories Market, by Industry Vertical, 2019-2027 ($Million)

Table 54. France Medium Voltage Cable Accessories Market, by Product Type, 2019-2027 ($Million)

Table 55. France Medium Voltage Cable Accessories Market, by Technology, 2019-2027 ($Million)

Table 56. France Medium Voltage Cable Accessories Market, by Installation, 2019-2027 ($Million)

Table 57. France Medium Voltage Cable Accessories Market, by Industry Vertical, 2019-2027 ($Million)

Table 58. Rest of Europe Medium Voltage Cable Accessories Market, by Product Type, 2019-2027 ($Million)

Table 59. Rest of Europe Medium Voltage Cable Accessories Market, by Technology, 2019-2027 ($Million)

Table 60. Rest of Europe Medium Voltage Cable Accessories Market, by Installation, 2019-2027 ($Million)

Table 61. Rest of Europe Medium Voltage Cable Accessories Market, by Industry Vertical, 2019-2027 ($Million)

Table 62. Asia-Pacific Medium Voltage Cable Accessories Market, by Product Type, 2019-2027 ($Million)

Table 63. Asia-Pacific Medium Voltage Cable Accessories Market, by Technology, 2019-2027 ($Million)

Table 64. Asia-Pacific Medium Voltage Cable Accessories Market, by Installation, 2019-2027 ($Million)

Table 65. Asia-Pacific Medium Voltage Cable Accessories Market, by Industry Vertical, 2019-2027 ($Million)

Table 66. China Medium Voltage Cable Accessories Market, by Product Type, 2019-2027 ($Million)

Table 67. China Medium Voltage Cable Accessories Market, by Technology, 2019-2027 ($Million)

Table 68. China Medium Voltage Cable Accessories Market, by Installation, 2019-2027 ($Million)

Table 69. China Medium Voltage Cable Accessories Market, by Industry Vertical, 2019-2027 ($Million)

Table 70. Japan Medium Voltage Cable Accessories Market, by Product Type, 2019-2027 ($Million)

Table 71. Japan Medium Voltage Cable Accessories Market, by Technology, 2019-2027 ($Million)

Table 72. Japan Medium Voltage Cable Accessories Market, by Installation, 2019-2027 ($Million)

Table 73. Japan Medium Voltage Cable Accessories Market, by Industry Vertical, 2019-2027 ($Million)

Table 74. India Medium Voltage Cable Accessories Market, by Product Type, 2019-2027 ($Million)

Table 75. India Medium Voltage Cable Accessories Market, by Technology, 2019-2027 ($Million)

Table 76. India Medium Voltage Cable Accessories Market, by Installation, 2019-2027 ($Million)

Table 77. India Medium Voltage Cable Accessories Market, by Industry Vertical, 2019-2027 ($Million)

Table 78. Rest of Asia-Pacific Medium Voltage Cable Accessories Market, by Product Type, 2019-2027 ($Million)

Table 79. Rest of Asia-Pacific Medium Voltage Cable Accessories Market, by Technology, 2019-2027 ($Million)

Table 80. Rest of Asia-Pacific Medium Voltage Cable Accessories Market, by Installation, 2019-2027 ($Million)

Table 81. Rest of Asia-Pacific Medium Voltage Cable Accessories Market, by Industry Vertical, 2019-2027 ($Million)

Table 82. LAMEA Medium Voltage Cable Accessories Market, by Product Type, 2019-2027 ($Million)

Table 83. LAMEA Medium Voltage Cable Accessories Market, by Technology, 2019-2027 ($Million)

Table 84. LAMEA Medium Voltage Cable Accessories Market, by Installation, 2019-2027 ($Million)

Table 85. LAMEA Medium Voltage Cable Accessories Market, by Industry Vertical, 2019-2027 ($Million)

Table 86. Latin America Medium Voltage Cable Accessories Market, by Product Type, 2019-2027 ($Million)

Table 87. Latin America Medium Voltage Cable Accessories Market, by Technology, 2019-2027 ($Million)

Table 88. Latin America Medium Voltage Cable Accessories Market, by Installation, 2019-2027 ($Million)

Table 89. Latin America Medium Voltage Cable Accessories Market, by Industry Vertical, 2019-2027 ($Million)

Table 90. Middle East Medium Voltage Cable Accessories Market, by Product Type, 2019-2027 ($Million)

Table 91. Middle East Medium Voltage Cable Accessories Market, by Technology, 2019-2027 ($Million)

Table 92. Middle East Medium Voltage Cable Accessories Market, by Installation, 2019-2027 ($Million)

Table 93. Middle East Medium Voltage Cable Accessories Market, by Industry Vertical, 2019-2027 ($Million)

Table 94. Africa Medium Voltage Cable Accessories Market, by Product Type, 2019-2027 ($Million)

Table 95. Africa Medium Voltage Cable Accessories Market, by Technology, 2019-2027 ($Million)

Table 96. Africa Medium Voltage Cable Accessories Market, by Installation, 2019-2027 ($Million)

Table 97. Africa Medium Voltage Cable Accessories Market, by Industry Vertical, 2019-2027 ($Million)

Table 98. Key Executives

Table 99. 3M: Company Snapshot

Table 100. 3M: Operating Segments

Table 101. 3M: Product Portfolio

Table 102. Key Executives

Table 103. Behr Bircher Cellpack Bbc Ag: Company Snapshot

Table 104. Behr Bircher Cellpack Bbc Ag: Operating Segments

Table 105. Behr Bircher Cellpack Bbc Ag: Product Portfolio

Table 106. Key Executives

Table 107. Compaq International: Company Snapshot

Table 108. Compaq International: Operating Segments

Table 109. Compaq International: Product Portfolio

Table 110. Key Executives

Table 111. Nexans: Company Snapshot

Table 112. Nexans: Operating Segments

Table 113. Nexans: Product Portfolio

Table 114. Key Executives

Table 115. Nkt A/S: Company Snapshot

Table 116. Nkt A/S: Operating Segments

Table 117. Nkt A/S: Product Portfolio

Table 118. Key Executives

Table 119. Phoenix Technology: Company Snapshot

Table 120. Phoenix Technology: Operating Segments

Table 121. Phoenix Technolog: Product Portfolio

Table 122. Key Executives

Table 123. Repl International: Company Snapshot

Table 124. Repl International: Operating Segments

Table 125. Repl International: Product Portfolio

Table 126. Key Executives

Table 127. Sumitomo Electric: Company Snapshot

Table 128. Sumitomo Electric: Operating Segments

Table 129. Sumitomo Electric: Product Portfolio

Table 130. Key Executives

Table 131. Te Connectivity: Company Snapshot

Table 132. Te Connectivity: Operating Segments

Table 133. Te Connectivity: Product Portfolio

Table 134. Key Executives

Table 135. Yamuna Info & Technology: Company Snapshot

Table 136. Yamuna Info& Technology: Operating Segments

Table 137. Yamuna Info & Technology: Product Portfolio

List of Figures

Figure 01. Key Market Segments

Figure 02. Executive Summary, by Segmentation

Figure 03. Executive Summary, by Region

Figure 04. Top Impacting Factors

Figure 05. Top Investment Pockets

Figure 06. Moderate Bargaining Power of Suppliers

Figure 07. Moderate Threat of New Entrants

Figure 08. Moderate Threat of Substitutes

Figure 09. Moderate Intensity of Rivalry

Figure 10. Low to Moderate Bargaining Power of Buyers

Figure 11. Global Medium Voltage Cable Accessories Market Share, by Product Type, 2019-2027 (%)

Figure 12. Global Medium Voltage Cable Accessories Market, by Product Type, 2019-2027 ($Million)

Figure 13. Comparative Share Analysis Medium Voltage Cable Accessories Market for Cable Joints & Splice, by Country, 2019 & 2027 (%)

Figure 14. Comparative Share Analysis Medium Voltage Cable Accessories Market for Connectors, by Country, 2019 & 2027 (%)

Figure 15. Comparative Share Analysis Medium Voltage Cable Accessories Market for Terminations, by Country, 2019 & 2027 (%)

Figure 16. Comparative Share Analysis Medium Voltage Cable Accessories Market for Others, by Country, 2019 & 2027 (%)

Figure 17. Global Medium Voltage Cable Accessories Market Share, by Technology, 2019-2027 (%)

Figure 18. Comparative Share Analysis of Medium Voltage Cable Accessories Market for Heat Shrink, by Country, 2019 & 2027 (%)

Figure 19. Comparative Share Analysis of Medium Voltage Cable Accessories Market for Cold Shrink, by Country, 2019 & 2027 (%)

Figure 20. Comparative Share Analysis of Medium Voltage Cable Accessories Market for Pre-Molded Terminations, by Country, 2019 & 2027 (%)

Figure 21. Global Medium Voltage Cable Accessories Market Share, by Installation, 2019-2027 (%)

Figure 22. Comparative Share Analysis of Overhead Medium Voltage Cable Accessories Market, by Country, 2019 & 2027 (%)

Figure 23. Comparative Share Analysis of Underground Medium Voltage Cable Accessories Market, by Country, 2019 & 2027 (%)

Figure 24. Comparative Share Analysis of Submedium Voltage Cable Accessories Market for Marine , by Country, 2019 & 2027 (%)

Figure 25. Global Medium Voltage Cable Accessories Market Share, by Industry Vertical, 2019-2027 (%)

Figure 26. Comparative Share Analysis of Medium Voltage Cable Accessories Market for Railways, by Country, 2019 & 2027 (%)

Figure 27. Comparative Share Analysis of Medium Voltage Cable Accessories Market for Construction, by Country, 2019 & 2027 (%)

Figure 28. Comparative Share Analysis of Medium Voltage Cable Accessories Market for Private Utilities, by Country, 2019 & 2027 (%)

Figure 29. Comparative Share Analysis of Medium Voltage Cable Accessories Market for Cement, by Country, 2019 & 2027 (%)

Figure 30. Comparative Share Analysis of Medium Voltage Cable Accessories Market for Marine, by Country, 2019 & 2027 (%)

Figure 31. Comparative Share Analysis of Medium Voltage Cable Accessories Market for Government Utilities, by Country, 2019 & 2027 (%)

Figure 32. Comparative Share Analysis of Medium Voltage Cable Accessories Market for Oil & Gas, by Country, 2019 & 2027 (%)

Figure 33. Comparative Share Analysis of Medium Voltage Cable Accessories Market for Healthcare, by Country, 2019 & 2027 (%)

Figure 34. Comparative Share Analysis of Medium Voltage Cable Accessories Market for Fertilizer, by Country, 2019 & 2027 (%)

Figure 35. Comparative Share Analysis of Medium Voltage Cable Accessories Market for Steel, by Country, 2019 & 2027 (%)

Figure 36. Comparative Share Analysis of Medium Voltage Cable Accessories Market for Others, by Country, 2019 & 2027 (%)

Figure 37. Medium Voltage Cable Accessories Market, by Region, 2019-2027 (%)

Figure 38. Comparative Share Analysis of North America Medium Voltage Cable Accessories Market, by Country, 2019-2027 (%)

Figure 39. U.S. Medium Voltage Cable Accessories Market, 2019-2027 ($Million)

Figure 40. Canada Medium Voltage Cable Accessories Market, 2019-2027 ($Million)

Figure 41. Mexico Medium Voltage Cable Accessories Market, 2019-2027 ($Million)

Figure 42. Comparative Share Analysis of Europe Medium Voltage Cable Accessories Market, by Country, 2019-2027 (%)

Figure 43. UK Medium Voltage Cable Accessories Market, 2019-2027 ($Million)

Figure 44. Germany Medium Voltage Cable Accessories Market, 2019-2027 ($Million)

Figure 45. France Medium Voltage Cable Accessories Market, 2019-2027 ($Million)

Figure 46. Rest of Europe Medium Voltage Cable Accessories Market, 2019-2027 ($Million)

Figure 47. Comparative Share Analysis of Asia-Pacific Medium Voltage Cable Accessories Market, by Country, 2019-2027 (%)

Figure 48. China Medium Voltage Cable Accessories Market, 2019-2027 ($Million)

Figure 49. Japan Medium Voltage Cable Accessories Market, 2019-2027 ($Million)

Figure 50. India Medium Voltage Cable Accessories Market, 2019-2027 ($Million)

Figure 51. Rest of Asia-Pacific Medium Voltage Cable Accessories Market, 2019-2027 ($Million)

Figure 52. Comparative Share Analysis of LAMEA Medium Voltage Cable Accessories Market, by Country, 2019-2027 (%)

Figure 53. Latin America Medium Voltage Cable Accessories Market, 2019-2027 ($Million)

Figure 54. Middle East Medium Voltage Cable Accessories Market, 2019-2027 ($Million)

Figure 55. Africa Medium Voltage Cable Accessories Market, 2019-2027 ($Million)

Figure 56. Market Player Positioning, 2019

Figure 57. Product Mapping of Top 10 Players

Figure 58. Competitive Dashboard

Figure 59. Competitive Heatmap of Key Players

Figure 60.3M Connectivity, 2018-2020 ($Million)

Figure 61.3M: Revenue, 2018-2020 ($Million)

Figure 62.3M: Revenue Share by Segment, 2020 (%)

Figure 63.3M: Revenue Share by Region, 2020 (%)

Figure 64. Nexans: Revenue, 2018-2020 ($Million)

Figure 65. Nexans: Revenue Share by Segment, 2020 (%)

Figure 66. Nexans: Revenue Share by Region, 2020 (%)

Figure 67. Nkt A/S, 2018-2020 ($Million)

Figure 68. Nkt A/S: Revenue, 2018-2020 ($Million)

Figure 69. Nkt A/S: Revenue Share by Region, 2020 (%)

Figure 70. Repl International: Revenue, 2018-2020 ($Million)

Figure 71. Sumitomo Electric, 2018-2020 ($Million)

Figure 72. Sumitomo Electric: Revenue, 2018-2020 ($Million)

Figure 73. Sumitomo Electric: Revenue Share by Segment, 2020 (%)

Figure 74. Sumitomo Electric: Revenue Share by Region, 2020 (%)

Figure 75. Te Connectivity, 2018-2020 ($Million)

Figure 76. Te Connectivity: Revenue, 2018-2020 ($Million)

Figure 77. Te Connectivity: Revenue Share by Segment, 2020 (%)

Figure 78. Te Connectivity: Revenue Share by Region, 2020 (%)

Purchase Report Here

About Research & Markets

Research and Markets was founded in 2002 with one simple aim; to connect businesses with the market insights and analysis they need to enable intelligent decision-making. Since then we have grown into the world’s largest market research store with clients all over the world, including 450+ of the Fortune 500 Clients, choosing to buy their research from us.

Headquartered beside the Guinness Brewery in Dublin Ireland, Research and Markets offers insight into over 800 industries from Automotive to Telecommunications to Zoology and (almost) everything in between!

At Research and Markets, we understand that the research we provide is only as good as the outcome it inspires. That’s why we are proud to provide the widest range of research products, multilingual 24/7 customer support and dedicated custom research services to deliver the insights you need to achieve your goals.

THORNE & DERRICK

T&D are Specialist Distributors to UK Distribution Network Operators (DNO’s), NERS Registered Service Providers, ICP’s and HV Jointing Contractors of an extensive range of LV, MV & HV Jointing, Earthing, Substation & Electrical Equipment – this includes 11kV/33kV/66kV joints, terminations and connectors for both DNO and private network applications.

Contact our UK Power Team for competitive quotations, fast delivery from stock and technical support or training on all LV-HV products.

Key Product Categories: Duct Seals | Cable Cleats | Cable Glands | Electrical Safety | Arc Flash Protection | Cable Jointing Tools | Cable Pulling | Earthing | Feeder Pillars | Cable Joints LV | Joints & Terminations MV HV

June 14th, 2021

Conference Name: Subsea Power Transmission & Cabling 2021

Dates: 16-17 September 2021

Start: September 16, 2021 13:00

End: September 17, 2021 17:00

Location: Virtual Event – Find out more here

Email: [email protected] Prospero Events Group helps decision-makers in the European energy industry benchmark best practices by organizing peer-to-peer conferences.

➡ 50% discount if booked before 30th June 2021 – BOOK NOW!

Virtual Conference

Subsea Power Transmission & Cabling 2021

With the growth of offshore power production and in order to meet net-zero, it is important to ensure high quality and reliable offshore grid infrastructure to integrate the growing offshore power production. Infrastructure development is also important to ensure the security of supply and to ensure cross-border energy trading. Talking about infrastructure development, new challenges in cable technology, design, installation and maintenance needs to be addressed as well.

Subsea Power Transmission & Cabling 2021 will bring together the most prominent European energy industry leaders in an exclusive closed-group and business-friendly environment for peer-to-peer networking to discuss challenges and opportunities of the strategic role of submarine power cable infrastructure, subsea power transmission and infrastructure development to support the expansion of offshore wind production and to secure the stability of power supply by sharing their business models and latest studies.

Bringing together decision-makers responsible for subsea power cables and offshore power transmission to discuss challenges and opportunities of the strategic role of submarine power cable infrastructure, subsea power transmission and infrastructure development.

TOPICS

- Expanding Offshore Production: Challenges for Grid Integration

- Case Study: The Belgian Offshore Grid from a Developer’s Perspective

- Business Models for Future Interconnectors

- Offshore Wind Integration: Status and way forward from Elia Group’s perspective

- Cable Repairment: Project Planning & Project Finance

- BritNed Cable: Operational Challenges & Project Updates

sPEAKERS

|

Bart Goethals CCO, Nemo Link, Belgium

Bart is in charge of the commercial aspects of the Nemo Link interconnector between Belgium and England which is the first ‘cap and floor’ interconnector.

Over the last ten year he has been working on multiple interconnector and offshore grid investment files.

|

|

Dr. Lorenz Müller, Head of Regulatory Affairs, 50Hertz, Germany

Lorenz Müller was born in 1972 in Dortmund, Germany. He studied electrical engineering and received a PhD at the Technical University of Dortmund, Germany.

In his professional career, he has executed different management positions in the company, e.g. responsible for grid usage and connection contracts, energy market development and the whole energy business of the company. |

|

Dennis Stufkens, Operations Directors, BritNed, The Netherlands

BritNed Development Limited is an international organisation with sites based in Great Britain and the Netherlands. They own and operate the electricity interconnector between Great Britain and the Netherlands and deliver world class asset reliability, vital to the energy needs of Great Britain and the Netherlands, and they do with it with a key focus on safety. |

|

Margot Van Nuffel, Project Finance Manager, Otary, Belgium

Since 2017 with Otary (Belgian knowledge centre for offshore wind energy that develops, finances, constructs and operates offshore wind parks) as the project finance manager. Leading the negotiations with Elia in 2019 on an asset sale to complement the Modular Offshore Grid, and assisting in the financing of SeaMade in 2018, the largest Belgian offshore windfarm. Responsible for the PPAs and the regulatory/market aspects of 800 MW of offshore wind assets. |

|

Luke Wainwright, Offshore Coordination Manager, National Grid ESO, UK

Luke Wainwright is an experienced leader in the Electricity System Operator for Great Britain, National Grid ESO. He has worked for National Grid for 20 years in a variety of Commercial, Project and Operational Leadership roles, including the leading the New Connections team for England and Wales and being Chief of Staff to the Director of Operations. At present he leads on Offshore Coordination, specifically the change programme to ensure the System Operator can achieve 40GW by 2030 whilst also balancing the needs and interests of coastal communities and

consumers.

|

|

Aoife Wixted, Senior Lead Engineer, Eirgrid, Ireland

EirGrid develop and operate the national electricity grid, so that everyone has power when and where they need it. The grid takes electricity from where it is generated and delivers it to the distribution network, operated by ESB, which powers every home, business, school, hospital, factory and farm on the island. They also supply power directly to some of Ireland’s largest energy users.

|

Prospero Events

Prospero Events help decision-makers in the European energy industry benchmark best practices by organizing peer-to-peer conferences.

Their promise is to offer the longest average minutes (at least 4 minutes per participant within two days of a virtual event) of direct peer-to-peer networking with the most senior, relevant, committed, innovative, and open-minded European professionals about specific energy industry-related topics.

Thorne & Derrick distribute the most extensive range of Low & High Voltage Cable Installation & Electrical Distribution Equipment to the Power Transmission & Distribution industry in the onshore and offshore wind, solar, rail, oil/gas, data centre, battery storage and utility sectors.

We service UK and international clients working on underground and subsea cables, overhead lines, substations and electrical construction at LV, 11kV/33kV and up to and EHV transmission and distribution voltages.

Key Products: MV-HV Cable Joints & Terminations, Cable Cleats, Duct Seals, Cable Transits, Underground Cable Protection, Copper Earth Tapes, Cable Jointing Tools, Feeder Pillars, Cable Ducting, Earthing & Lightning Protection, Electrical Safety, Cable Glands, Arc Flash Clothing & Protection & Fusegear.

Distributors for: 3M Electrical, ABB, Alroc, Band-It, Cembre, Centriforce, CMP, Elastimold, Ellis Patents, Emtelle, Furse, Lucy Zodion, Nexans Euromold, Pfisterer, Polypipe, ProGARM, Prysmian, and Roxtec.

- Scope –single-source supply of extensive range of products

- Stock – a multi-million pound stock holding provides complete global supply solutions

- Staff – technical support from a trained, proactive and friendly team

- Delivery – UK stock turnaround with express logistics to all international destinations

March 16th, 2021

Underground Transmission Projects

WEBINAR

How Do you Manage Risk For Underground Transmission Projects?

Burns & McDonnell, one of PDi2’s member organizations, is sponsoring a free webinar on March 30th. The discussion will focus on the risks typical to underground transmission projects and how to manage those risks during various stages of the project.

WEBINAR: Tuesday, March 30, 2021 | 11AM ET / 8AM PT

Underlying any construction project, inherent risks exist.

For underground transmission projects, risks can range from subsurface conditions to existing utilities to interface points and more.

What can an organisation do to mitigate these risks throughout the project life? Risk mitigation can occur through multiple avenues including site investigations, contracting strategies, design and even construction.

This presentation will discuss risks to typical underground transmission projects and how those risks can be managed during various stages of project delivery.

Additionally, the presentation will explore unique risks to subsea cable projects and how engineer-procure-construct (EPC) project delivery for underground transmission projects can be a beneficial project approach.

Speakers:

Tyler McArthur, PE, ENV SP, Civil/Structural Engineer, Burns & McDonnell

Tyler McArthur is a civil/structural engineer in the underground transmission group at Burns & McDonnell. His responsibilities include cable duct bank design, underground routing analysis, cable pulling tension calculations, duct bank construction estimates and underground transmission line construction support.

His work includes use of cable pull 3D design/analysis software packages and several in-house design and cost estimating programs. Tyler also has experience working in the firm’s overhead transmission and substation groups.

Nathan Rochel, PE, P.Eng, Electrical Engineer, Burns & McDonnell

Nathan Rochel is an electrical engineer specialising in the design of underground transmission lines and management of the underground transmission department.

He has been involved in the design of underground transmission projects ranging from 5-kV through 500-kV. His experience includes all aspects of underground transmission design, including front-end planning, routing, permitting and feasibility, through detailed design, construction support, commissioning and testing.

Nathan’s project experience has covered investor-owned utility transmission installations, developer interconnects, renewable installations (solar, wind and offshore wind), inside station connections, industrial installations, trenchless installations, generation ties and more.

David Slee, Program Manager, Burns & McDonnell

David Slee is a program manager specializing in the installation and protection of marine cables, pipelines and structures at Burns & McDonnell.

He has more than 30 years of experience in the implementation and connection of renewable and nonconventional energy to the grid.

David has provided consultation services to several utilities and businesses in the energy sector, in particular offshore wind with associated cabling, wave and tidal energy, and some onshore renewables.

Burns & McDonnell is a full-service engineering, architecture, construction, environmental and consulting solutions firm, based in Kansas City, Missouri.

Transmission & Distribution World’s mission is to provide utility executives, managers, engineers, supervisors, operators and linemen with must-read information on:

- Design

- Engineering

- Construction

- Operation

- Maintenance of the Electric Power-Delivery Systems

THORNE & DERRICK

Thorne & Derrick are national distributors of LV, MV & HV Cable Installation, Jointing, Substation & Electrical Equipment – servicing businesses involved in cabling, jointing, substation, earthing, overhead line and electrical construction at LV, 11kV, 33kV, 66kV and EHV. Supplying a complete range of power cable accessories to support the installation and maintenance of low/medium and high voltage power systems:

- Slip-on Cable Terminations

- Cold-shrink Cable Terminations

- Heat-shrink Cable Terminations

- Cable Joints – Heat & Cold-shrink

- Separable Connectors (Euromold)

- Surge Arresters & Switchgear/Transformer Bushings

Key Product Categories: Duct Seals | Cable Cleats | Cable Glands | Electrical Safety | Arc Flash Protection | Cable Jointing Tools | Cable Pulling | Earthing | Feeder Pillars | Cable Joints LV | Joints & Terminations MV HV